Australia is home to more than 46,000 real estate businesses. If yours is among them, you’ll know how tough working in and around the property industry can be. The right real estate insurance cover can make it easier to weather the ups and downs and overcome challenges that could otherwise see the firm you’ve fought hard to establish and grow, go to the wall.

So, what insurance do real estate businesses need? This is the cover that will protect you from some of the most common business risks.

Owning or managing a real estate business can be rewarding – but it’s not without risk. Whether you’re a property manager, real estate agent or agency owner, unexpected events can cause significant financial and operational disruption if you’re not properly insured.

Real estate businesses often operate from physical offices or manage rental properties. If you own a premises, building insurance is often a must. It’s there to help cover the cost of relocating your operations and repairing the damage, in the event of disaster.

Property insurance, meanwhile, will help defray the cost of replacing lost, stolen or damaged equipment.

Also essential is public liability and workers compensation insurance to help cover the costs, should an employee or member of the public injure themselves while on your premises, or on the job.

“Historically, professional indemnity insurance was only recommended for accountants, lawyers, architects and other providers of professional services, but these days real estate agents must have it too”, explains Steadfast broker technical manager Michael White.

“One of the most common kinds of professional indemnity claims against a real estate agent is by a tenant who is injured at a rental residential property you manage. There’s a strong chance the tenant will make a claim against your agency, as well as their landlord”, White says.

Usually, the claim is based on allegedly unactioned maintenance requests.

“A tenant may report an electrical fault, for example, but, as an agent, you have limited authority to authorise a repair, should the landlord be unwilling to spend the money,” White explains.

If a hazard is left unrepaired and someone is injured as a result, multiple parties involved in the property’s management may face legal action, including the agent overseeing the property.

Professional indemnity insurance may provide cover for such claims, provided your policy doesn’t specifically exclude personal injury and property damage.

In 2025, cybercrime is a real and rising risk and local business owners of all stripes need to be on their guard. The Australian Cyber Security Hotline received an average of 100 calls a day in the last financial year, according to the Australian Signals Directorate’s Annual Cyberthreat Report 2023-2024.

Recent years have seen real estate businesses become a prime target for bad actors, for two reasons. They hold large amounts of valuable personal information – think tenants’ personal ID and bank account details – and they facilitate high value transactions, when properties are bought and sold.

Incidents and attacks don’t just have the potential to disrupt your operations; remedying them can also cost you dearly, both reputationally and financially. In 2023-24, the average self-reported cost of a cyber-crime incident was $49,600 for small businesses, the Report reveals. For medium sized businesses, that figure rose to $62,800, while larger enterprises shelled out $63,600.

Hardening your high-tech defences will make your real estate business less attractive to hackers and cyber criminals.

And if you’re unfortunate enough to experience an attack, cyber insurance can help cover your losses and the cost of remediation.

Business interruptions due to insured events such as fire, flood or equipment failure can prevent you from trading. Business interruption insurance helps maintain your income, cover fixed operating costs and keep your business afloat during the recovery period.

If you have staff, there’s always a risk of workplace injury, unfair dismissal claims or other employment disputes. Workers’ compensation and management liability cover are important protections for agency owners and managers.

Reviewing your real estate insurance cover will help you determine whether you have the right type and level of cover in place. If you’d like some help to clarify what’s included in your current policies, reach out to your AIB insurance broker today.

Important notice

This article is of a general nature only and does not take into account your specific objectives, financial situation or needs. It is also not financial advice, nor complete, so please discuss the full details with your Steadfast insurance broker as to whether these types of insurance are appropriate for you. Deductibles, exclusions and limits apply. You should consider any relevant Target Market Determination and Product Disclosure Statement in deciding whether to buy or renew these types of insurance. Various insurers issue these types of insurance and cover can differ between insurers.

Steadfast Group Ltd ACN 073 659 677

Important notice – Steadfast Group Limited ABN 98 073 659 677

This article provides information rather than financial product or other advice. The content of this article, including any information contained in it, has been prepared without taking into account your objectives, financial situation or needs. You should consider the appropriateness of the information, taking these matters into account, before you act on any information. In particular, you should review the product disclosure statement for any product that the information relates to it before acquiring the product.

Information is current as at the date the article is written as specified within it but is subject to change. Steadfast Group Ltd and Steadfast Network Brokers make no representation as to the accuracy or completeness of the information. Various third parties have contributed to the production of this content. All information is subject to copyright and may not be reproduced without the prior written consent of Steadfast Group Limited.

Aussies love a backyard, so it’s no surprise landscape gardeners are thriving. A number of different business models operate across the sector, including sole traders and proprietary limited companies and insurance differs across these options. Gardening insurance is vital for a variety of these different small business types including landscapers, gardeners, tree loppers, garden maintenance and lawn mowing businesses

There are also state-based variances in the cover landscape gardeners can secure. When we talk about landscape gardeners, we mean people who look after tasks like mowing, weeding, planting, removing dead plants and edging.

Here are some of the main insurances landscape gardeners need to think about and the risks they cover.

Landscape gardeners should have public liability insurance to protect against claims from third-party injuries like a client tripping over equipment or property damage like accidentally breaking a fence or irrigation system.

Property insurance is essential for landscape gardeners to cover replacement costs if tools, machinery or materials like lawnmowers and edgers are stolen from job sites or vehicles.

Car insurance protects against road accidents, damage or third-party claims that happen to work-related transport, such as vans carrying equipment or trailers hauling debris.

If an individual establishes a company, they can take on a role as an employee within the business, making them eligible for workers’ compensation insurance in all states except Queensland. However, individuals operating a business as a sole trader cannot be classified as employees and are not eligible for workers’ compensation insurance for themselves. In such cases, alternative coverage, such as income protection insurance, may be necessary.

It can be hard for manual occupations such as landscape gardeners to get income protection cover. People who work in these occupations may be able to take out personal accident cover, but this is more limited.

“Taking out workers’ comp in a corporate structure is more generous than personal accident cover. With workers’ compensation, if you get injured, you can keep on claiming until age 65 or whatever the policy’s cutoff date is. Whereas personal accident cover usually ends after 12 months. Income protection insurance is a lot more comprehensive, but it’s a lot more expensive as well,” says Steadfast broker technical manager Michael White.

A business pack combines policies like public liability, equipment and income protection into a single solution, streamlining risk management.

Tree lopping tends to require specialist equipment and a different approach to risk management.

Insurers normally include clauses in tree loppers’ policies that require them to take certain precautions. For instance, they may require a certain number of people to be employed on jobs. The policy may also detail the safety precautions required to perform tasks such as lowering branches to the ground.

“Insurers want to know these procedures have been followed if there is a claim,” says White.

“Insuring landscape gardeners is usually pretty straight forward, unless there is some unusual aspect to the business. But it can be hard to place cover for tree loppers because of the risk of falling branches hitting someone,” he says.

Most insurers will not write liability cover for tree loppers, although it’s possible to get cover in specialised markets.

“Compared to landscape gardeners, tree loppers have heavier vehicles and heavier equipment, such as big mulchers.

An AIB broker may be able to identify insurers willing to accept the risks with this kind of equipment,” says White.

Talk to your Steadfast broker today

An experienced AIB insurance broker can help landscape gardeners and tree loppers get the right gardening insurance cover for their business and its assets, so talk to one today.

Important notice

This article is of a general nature only and does not take into account your specific objectives, financial situation or needs. It is also not financial advice, nor complete, so please discuss the full details with your Steadfast insurance broker as to whether these types of insurance are appropriate for you. Deductibles, exclusions and limits apply. You should consider any relevant Target Market Determination and Product Disclosure Statement in deciding whether to buy or renew these types of insurance. Various insurers issue these types of insurance and cover can differ between insurers.

Steadfast Group Ltd ACN 073 659 677

Important notice – Steadfast Group Limited ABN 98 073 659 677

This article provides information rather than financial product or other advice. The content of this article, including any information contained in it, has been prepared without taking into account your objectives, financial situation or needs. You should consider the appropriateness of the information, taking these matters into account, before you act on any information. In particular, you should review the product disclosure statement for any product that the information relates to it before acquiring the product.

Information is current as at the date the article is written as specified within it but is subject to change. Steadfast Group Ltd and Steadfast Network Brokers make no representation as to the accuracy or completeness of the information. Various third parties have contributed to the production of this content. All information is subject to copyright and may not be reproduced without the prior written consent of Steadfast Group Limited.

Running a professional services business – whether you’re a lawyer, accountant, engineer or consultant – comes with opportunities, but also challenges and risks. While your expertise and knowledge are your primary assets, they also expose you to potential liabilities that can have significant financial and reputational consequences. This is where professional services insurance cover becomes invaluable.

Understanding these risks and having the right insurance cover in place is crucial to help protect your business.

Professional negligence, or errors and omissions, is a significant risk for professional services businesses.

This happens when a client claims your advice, service or work was incorrect, incomplete or failed to meet the expected standard, resulting in financial loss or other damages. Even the most experienced professionals can make mistakes, and the consequences can be severe, which is why insurance is important.

Breach of contract claims can happen if you fail to deliver services as agreed in a contract. This includes missing deadlines, not meeting the scope of work or not adhering to the terms and conditions outlined in the agreement.

These claims can lead to costly legal battles and damage your business’s reputation.

Data breaches are expensive, with research indicating cyberattacks cost Australian small businesses like lawyers and accountants $300 million a year.

Professional services businesses handle a vast amount of sensitive client data, which makes them attractive targets for cybercriminals. A data breach or cyberattack can mean client and confidential firm information is stolen or compromised, leading to extremely serious consequences like financial losses, legal liabilities and damage to your business’s reputation.

All firms that employ people face the risk their staff will be injured in the workplace.

It’s mandatory under state-based laws that all businesses, including professional services firms, have cover for risks such as workplace injuries.

These are some of the main insurances professional services firms need to have in place.

This is the cornerstone coverage when it comes to professional services insurance. It can provide cover for claims of negligence, errors, omissions or breaches of duty in the services you provide.

Professional Indemnity (PI) insurance can cover legal costs and damages awarded to the claimant, so your business can keep operating without a lawsuit taking up the lion’s share of the business’s resources and time.

Here are some of the benefits PI insurance may provide:

Public liability insurance provides cover for your business for claims for bodily injury or property damage to third parties such as clients, visitors or members of the public from your business activities.

While professional services businesses may not have the same level of physical interaction as other industries, there is still a risk of accidents occurring on your premises or as a result of your work. So, this cover can be important.

Cyber insurance can help protect your business against the financial losses and liabilities associated with data breaches, cyberattacks and other cyber-related incidents. This coverage is important for professional services businesses that handle sensitive client data and rely heavily on digital systems.

Cyber insurance can provide cover for:

Workers’ compensation insurance is mandatory across all states and territories in Australia.

It can cover staff’s medical expenses, rehabilitation costs and lost wages due to work-related injuries or illnesses. Having adequate workers’ compensation insurance helps firms meet their legal obligations.

D&O insurance can help protect the personal assets of directors and officers of your business in the event they are sued for alleged wrongful acts in managing the company.

This cover is particularly important for professional services businesses that have a board of directors.

Business interruption insurance may cover the loss of income and additional expenses if your operations are disrupted due to an event like a natural disaster, fire or cyberattack. This can help your business to continue to meet its financial obligations like staff wages while the business gets up and running again.

Having the right insurance helps protect your business against the most common claims. Talk to your AIB broker today about understanding your risks and ensuring you have comprehensive insurance coverage so you can focus on what you do best, delivering high-quality professional services to your clients.

Important notice

This article is of a general nature only and does not take into account your specific objectives, financial situation or needs. It is also not financial advice, nor complete, so please discuss the full details with your Steadfast insurance broker as to whether these types of insurance are appropriate for you. Deductibles, exclusions and limits apply. You should consider any relevant Target Market Determination and Product Disclosure Statement in deciding whether to buy or renew these types of insurance. Various insurers issue these types of insurance and cover can differ between insurers.

Steadfast Group Ltd ACN 073 659 677

Important notice – Steadfast Group Limited ABN 98 073 659 677

This article provides information rather than financial product or other advice. The content of this article, including any information contained in it, has been prepared without taking into account your objectives, financial situation or needs. You should consider the appropriateness of the information, taking these matters into account, before you act on any information. In particular, you should review the product disclosure statement for any product that the information relates to it before acquiring the product.

Information is current as at the date the article is written as specified within it but is subject to change. Steadfast Group Ltd and Steadfast Network Brokers make no representation as to the accuracy or completeness of the information. Various third parties have contributed to the production of this content. All information is subject to copyright and may not be reproduced without the prior written consent of Steadfast Group Limited.

If your business manufactures or sells products to the public, product liability insurance can be very important. It’s a type of cover that’s designed to protect you from legal action by individuals who claim to have suffered personal injury or property damage from using or being exposed to the items you provide.

The most famous instance of this is arguably the McDonalds hot coffee case, a 1994 American lawsuit which saw an elderly woman sue the fast food giant after she suffered third degree burns from a drive-through cup of coffee she’d spilt in her lap.

Her lawyers argued that because of the high temperature at which the company required it to be served, McDonalds coffee was more likely to cause serious injury than the hot drinks sold by other outlets. The woman was subsequently awarded damages of almost $US3 million, a sum later reduced on appeal.

Irrespective of whether or not they’re at fault, personal injury and property claims can be ruinously expensive for small businesses that don’t have the deep pockets of their multinational counterparts.

Product liability insurance can help defray the cost of defending an action against your business and of any damages you may be required to pay.

Many insurers aim to provide small businesses with comprehensive coverage by bundling public and product liability insurance policies together.

But, depending on the nature of your product offering, it’s possible your business may require higher or more specialised product liability insurance cover.

Should it produce or sell pharmaceuticals, for example, a manufacturing error or contamination scare could necessitate the recall of an entire batch of products. The key thing is the defect has to have caused, or have the potential to cause, personal injury or property damage.

A product might be recalled because it is in the wrong packaging, for instance if it is chocolate cake but the packaging says it is vanilla cake. If someone bought the incorrectly labelled cake and then consumed it, the question is whether eating the chocolate cake would cause, or have the potential to cause, personal injury or property damage.

Contaminated products and recall insurance can help cover the costs associated with that exercise. It’s a type of cover that’s designed to help manufacturers and retailers of topical and ingestible products minimise the losses they incur when their products are contaminated accidentally or found to be defective.

As well as defraying the cost of the recall itself, contaminated products and recall insurance can help cover the cost of lost sales for the period in which your products are off the shelf.

Product liability insurance can be a complex affair, with numerous contingencies to consider. An experienced broker can help you work through them and identify policy options that are appropriate for your circumstances, Steadfast broker technical manager Michael White says.

“Understanding the nature of your organisation and its risk profile is critical,” he says.

“The right broker will be familiar with the commercial landscape you operate in and will be able to recommend product liability cover that matches the size and scope of your activities.”

If it’s been a while since your business reviewed its product liability cover, now is a great time to do so. Contact your AIB broker to explore your policy options.

Important notice

This article is of a general nature only and does not take into account your specific objectives, financial situation or needs. It is also not financial advice, nor complete, so please discuss the full details with your Steadfast insurance broker as to whether these types of insurance are appropriate for you. Deductibles, exclusions and limits apply. You should consider any relevant Target Market Determination and Product Disclosure Statement in deciding whether to buy or renew these types of insurance. Various insurers issue these types of insurance and cover can differ between insurers.

Steadfast Group Ltd ACN 073 659 677

Important notice – Steadfast Group Limited ABN 98 073 659 677

This article provides information rather than financial product or other advice. The content of this article, including any information contained in it, has been prepared without taking into account your objectives, financial situation or needs. You should consider the appropriateness of the information, taking these matters into account, before you act on any information. In particular, you should review the product disclosure statement for any product that the information relates to it before acquiring the product.

Information is current as at the date the article is written as specified within it but is subject to change. Steadfast Group Ltd and Steadfast Network Brokers make no representation as to the accuracy or completeness of the information. Various third parties have contributed to the production of this content. All information is subject to copyright and may not be reproduced without the prior written consent of Steadfast Group Limited.

If you own a townhouse, unit, or apartment and you’re sharing common space with others, you don’t want to be left to foot the bill if there’s damage to shared parts of the building or items. But what is strata insurance, what does it cover and how do you select the right policy for your needs?

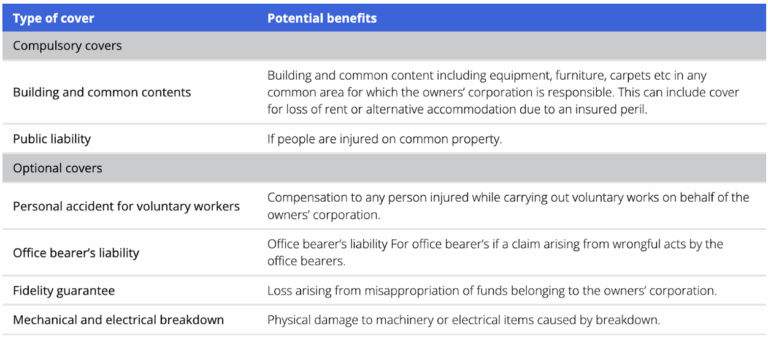

Strata Insurance, also known as Body Corporate Insurance, is a type of insurance policy designed for properties with shared spaces, such as apartment buildings, townhouses and commercial complexes in Australia. It covers the building’s common areas or shared property under the management of a strata title or body corporate entity. This insurance is mandatory in all Australian states and territories, ensuring that all unit owners are collectively protected against potential risks associated with property ownership and shared spaces.

Strata insurance typically covers:

For anything inside your unit or apartment, including contents, liability, or landlord protection, separate contents insurance or landlord insurance is recommended.

Strata title insurance is relevant for properties where ownership is divided into individual lots with shared common property. This includes:

Having the right strata building insurance is crucial for:

A well-structured policy ensures smooth operation of the strata scheme and peace of mind for all owners.

Building insurance usually refers to standalone cover for a single residential home and covers the structure of the building from events like fire, storm, or accidental damage.

Strata insurance, on the other hand, is tailored for multi-unit dwellings under a strata title, where multiple owners share ownership of the building’s common areas and structure.

Key differences:

With as many as 85% of recently-built strata properties having at least one known defect, according to UNSW research, the good news is that buildings with defects are still insurable.

The severity of the defects, the age of the building, outstanding legal action and any plans for defect rectification will be taken into consideration by insurers when deciding the type and extent of cover that they will offer, and the premium.

A well-tailored strata building insurance solution will also consider the building’s location, the number of tenants, the kinds of facilities and shared common areas, the reputation and track record of the building company, and the age of the building.

At AIB Insurance, we understand that every strata complex is unique. Whether you’re a strata manager, a body corporate representative or an individual unit owner, we can help you find the right strata title insurance policy to suit your needs and budget.

Our brokers compare a range of trusted insurers and work closely with you to ensure your strata building insurance provides:

With expert advice and access to tailored insurance solutions, contact our team today for simple and stress-free advice.

Important notice

This article is of a general nature only and does not take into account your specific objectives, financial situation or needs. It is also not financial advice, nor complete, so please discuss the full details with your Steadfast insurance broker as to whether these types of insurance are appropriate for you. Deductibles, exclusions and limits apply. You should consider any relevant Target Market Determination and Product Disclosure Statement in deciding whether to buy or renew these types of insurance. Various insurers issue these types of insurance and cover can differ between insurers.

Steadfast Group Ltd ACN 073 659 677

Important notice – Steadfast Group Limited ABN 98 073 659 677

This article provides information rather than financial product or other advice. The content of this article, including any information contained in it, has been prepared without taking into account your objectives, financial situation or needs. You should consider the appropriateness of the information, taking these matters into account, before you act on any information. In particular, you should review the product disclosure statement for any product that the information relates to it before acquiring the product.

Information is current as at the date the article is written as specified within it but is subject to change. Steadfast Group Ltd and Steadfast Network Brokers make no representation as to the accuracy or completeness of the information. Various third parties have contributed to the production of this content. All information is subject to copyright and may not be reproduced without the prior written consent of Steadfast Group Limited.

For small business owners, dealing with an insurance claim can be a bewildering experience, especially if you have never had to make a claim before. So, it pays to know who does what when it’s time to ring your broker to let them know you’ve had an insurable event.

After all, if a tree has smashed through your factory, a kitchen fire has destroyed your café, or anything in between, trying to figure out everyone’s roles will be the last thing on your mind.

So, whether it’s a claim for property damage, liability or business interruption, understanding who’s involved and what each party does can help demystify the process .

Your insurance broker is typically your first point of contact when a claim arises. They act as your advocate, guiding you through the claims process and liaising with the insurer on your behalf. Their role is to help present your claim accurately and assist you to receive the full benefits of your policy. Brokers can also provide advice on how to document your loss and steps to take immediately following a loss.

Once you’ve contacted your broker, the insurer steps in to assess the claim. Their job is to evaluate the situation and determine whether the claim is covered under your policy. This involves reviewing the details of the loss, examining the documentation provided and deciding on coverage and the amount of compensation. The insurer’s claims adjuster may visit your business premises to assess the damage firsthand.

In some cases, a loss assessor may be appointed to provide an independent evaluation of the claim. Unlike the insurer’s claims adjuster, a loss assessor works on your behalf. They can be particularly helpful in complex claims where significant property damage or loss is involved. By providing an unbiased assessment, they can help you to receive a fair settlement.

When physical damage to your property is involved, a builder or contractor may be part of the process. They are responsible for carrying out the repairs or restoration work needed to return your business premises to its pre-loss condition. It’s crucial to work with reputable and experienced professionals who can provide quality work within the scope of the insurance approval.

Other experts may be called in, depending on your claim. For example, if your claim involves technical aspects like machinery breakdown or cyber incidents, specialists in those fields may be consulted to provide their input. These experts help ensure technical details are considered and addressed. Understanding who’s involved in an insurance claim and their respective roles can alleviate much of the confusion and stress associated with the process. With an in-house claims team, your AIB broker can guide you through each step of the way.

Important notice

This article is of a general nature only and does not take into account your specific objectives, financial situation or needs. It is also not financial advice, nor complete, so please discuss the full details with your Steadfast insurance broker as to whether these types of insurance are appropriate for you. Deductibles, exclusions and limits apply. You should consider any relevant Target Market Determination and Product Disclosure Statement in deciding whether to buy or renew these types of insurance. Various insurers issue these types of insurance and cover can differ between insurers.

Steadfast Group Ltd ACN 073 659 677

Important notice – Steadfast Group Limited ABN 98 073 659 677

This article provides information rather than financial product or other advice. The content of this article, including any information contained in it, has been prepared without taking into account your objectives, financial situation or needs. You should consider the appropriateness of the information, taking these matters into account, before you act on any information. In particular, you should review the product disclosure statement for any product that the information relates to it before acquiring the product.

Information is current as at the date the article is written as specified within it but is subject to change. Steadfast Group Ltd and Steadfast Network Brokers make no representation as to the accuracy or completeness of the information. Various third parties have contributed to the production of this content. All information is subject to copyright and may not be reproduced without the prior written consent of Steadfast Group Limited.

Australia is home to thousands of businesses that organise and stage corporate and leisure events. If yours is among them, you’ll likely know it’s an industry where the unexpected can and does happen. Event insurance can help mitigate the risks of disruption and help you take setbacks in your stride.

From wet weather wash-outs to pandemic shutdowns, there’s no shortage of things that can scupper even the most meticulously planned events.

Having the right insurance cover can help make it easier to take disruption in your stride and recover from setbacks that might otherwise sink your operations.

So, what insurance do events businesses need? Steadfast broker technical manager Michael White outlines the cover that can protect your enterprise from some of the most common events related risks.

An artist calls off a performance mid-tour, torrential rain forces organisers to pull the pin on an outdoor festival at the eleventh hour, a keynote speaker is taken ill unexpectedly and can’t be replaced, or a building hired for an event is damaged in a storm and cannot be used. There are lots of reasons why events need to be cancelled and when they are, it can be ruinously expensive for the organisers.

That’s where cancellation of events cover comes into play. If your event is unavoidably postponed, abandoned or cancelled, it can help defray the non-recoverable costs you’ve incurred.

If patrons or staff are injured while attending or working at an event, they may be entitled to seek compensation from the organiser or promoter.

Public liability insurance may help you cover the cost, should that occur.

But, irrespective of the nature of your operations, making workplace health and safety a priority can help reduce the likelihood of accidents and incidents.

“Prevention is always better than cure,” White says. “Training your team and mandating safe practices for attendees and workers will serve your business well.”

Depending on the type of events you stage, the value of your equipment may run into the tens of thousands of dollars. Should it become lost, stolen or damaged – accidentally, deliberately or in an extreme weather event – property insurance can help fund its replacement.

And if you operate out of your own premises, you’ll want to ensure you have a building insurance policy that covers the cost of relocating to an alternative venue and repairing the damage, in the event of a disaster.

Unexpected incidents and events can make it impossible for your events company to maintain business as usual. Should that be the case, you’ll need business interruption insurance to fall back on – a type of cover that can help you maintain cash flow if your enterprise is knocked out of action.

“If you’re unable to trade, for a short or long period, it can be a lifeline,” White says.

In recent years, cyber-crime has become an existential threat for businesses. The Australian Cyber Security Centre received 94,000 cyber-crime reports in FY2023, a 14 per cent increase on FY2022’s figure.

Attacks can be costly and disruptive. It is reported small businesses are now spending an average of $46,000 on recovery and remediation while for medium sized businesses the figure rises to $97,200.

Implementing the Essential 8 mitigation strategies proposed by the Australian Government can make it harder for hackers and cyber criminals to compromise your systems. And cyber insurance can help further cover your losses and remediation costs, should you have the misfortune to fall victim.

Cyber Wardens is a free online cyber security course funded by the Australian Government which may assist in small businesses in becoming more familiar with cyber threats.

If you haven’t reviewed your business insurance for a while, now is a great time to do so. To discuss all your events business cover needs, contact your AIB broker today.

Important notice

This article is of a general nature only and does not take into account your specific objectives, financial situation or needs. It is also not financial advice, nor complete, so please discuss the full details with your Steadfast insurance broker as to whether these types of insurance are appropriate for you. Deductibles, exclusions and limits apply. You should consider any relevant Target Market Determination and Product Disclosure Statement in deciding whether to buy or renew these types of insurance. Various insurers issue these types of insurance and cover can differ between insurers.

Steadfast Group Ltd ACN 073 659 677

Important notice – Steadfast Group Limited ABN 98 073 659 677

This article provides information rather than financial product or other advice. The content of this article, including any information contained in it, has been prepared without taking into account your objectives, financial situation or needs. You should consider the appropriateness of the information, taking these matters into account, before you act on any information. In particular, you should review the product disclosure statement for any product that the information relates to it before acquiring the product.

Information is current as at the date the article is written as specified within it but is subject to change. Steadfast Group Ltd and Steadfast Network Brokers make no representation as to the accuracy or completeness of the information. Various third parties have contributed to the production of this content. All information is subject to copyright and may not be reproduced without the prior written consent of Steadfast Group Limited.

For many business owners in Australia, understanding and choosing the right insurance cover for their business can be confusing and time consuming. One of the questions we most frequently get asked is about the difference between public liability and professional indemnity insurance. Ensuring you have the right insurance coverage is crucial for protecting your business against financial and legal risks and these two covers are among the most important forms of business insurance. But what do they cover and how do they differ?

In this guide, we’ll provide a definition of both public liability and professional indemnity insurance, highlight the key differences, explain which businesses need them and provide a checklist of the risks each policy helps mitigate.

Public liability insurance protects businesses against claims for injury or property damage suffered by third parties due to your business activities. This includes incidents that occur on your premises, at a client’s site or as a result of your services or products.

What It Can Cover:

✔ Injury to customers, clients or members of the public due to your business activities.

✔ Property damage caused by your business.

✔ Legal fees and compensation costs associated with a claim.

Example Scenarios:

Professional indemnity insurance (also known as PI Insurance or Errors and Omissions cover) is a form of liability insurance designed for businesses that provide professional services, advice or expertise. It protects against claims of negligence, errors or omissions that could lead to financial loss for a client.

What It Can Cover:

✔ Claims of professional negligence or misconduct.

✔ Legal costs associated with defending a claim including inquiry costs by a regulatory body

✔ Direct financial loss of the business caused by the dishonest or fraudulent conduct of an employee which is first discovered during the period of insurance

✔ Compensation for financial losses suffered by clients due to your advice or services.

✔ Public relations & crisis management expenses

Example Scenario:

Certain businesses may need one or both types of cover.

Some businesses require both public liability and professional indemnity insurance to be fully protected. These include:

✅ Injury to customers or third parties on your premises or job site.

✅ Accidental property damage caused by your business operations.

✅ Legal costs associated with defending claims.

✅ Compensation payouts for injuries or damages.

✅ Claims of professional negligence or incorrect advice.

✅ Financial losses suffered by clients due to mistakes or omissions.

✅ Breach of professional duty or misleading service claims.

✅ Legal defence costs and compensation payments.

Whether you need public liability insurance, professional indemnity insurance or both, the right cover is essential to protect your business from financial and legal risks. At AIB, we specialise in helping businesses find the best insurance solutions tailored to their industry and risk profile. Our Business Pack insurance packages include some of the most common covers that you might need.

Get a quote today to ensure your business is fully covered and prepared for any potential claims.

Important notice

This article is of a general nature only and does not take into account your specific objectives, financial situation or needs. It is also not financial advice, nor complete, so please discuss the full details with your Steadfast insurance broker as to whether these types of insurance are appropriate for you. Deductibles, exclusions and limits apply. You should consider any relevant Target Market Determination and Product Disclosure Statement in deciding whether to buy or renew these types of insurance. Various insurers issue these types of insurance and cover can differ between insurers.

Steadfast Group Ltd ACN 073 659 677

Important notice – Steadfast Group Limited ABN 98 073 659 677

This article provides information rather than financial product or other advice. The content of this article, including any information contained in it, has been prepared without taking into account your objectives, financial situation or needs. You should consider the appropriateness of the information, taking these matters into account, before you act on any information. In particular, you should review the product disclosure statement for any product that the information relates to it before acquiring the product.

Information is current as at the date the article is written as specified within it but is subject to change. Steadfast Group Ltd and Steadfast Network Brokers make no representation as to the accuracy or completeness of the information. Various third parties have contributed to the production of this content. All information is subject to copyright and may not be reproduced without the prior written consent of Steadfast Group Limited.

Insurance is often a must-have when you’re running your own show. Whatever the nature of your enterprise, insurance is there to help you bounce back after an accident or incident. Understanding the insurance trends that are affecting the market can help you with your broker select the type and level of cover that’s right for your small business.

QIB Group CEO Tim Mathieson outlines some of the insurance trends you need to be across in 2025.

Australia is known as the land of fire and flooding rain. The increasing frequency and severity of natural disasters is prompting small businesses to review their climate risk related policies and, in many instances, extend their cover. That can be an expensive affair, which is why many owners are mitigating the cost of by opting for higher excesses on their various policies.

“If affordability is a challenge, this approach can help you manage the impost while remaining covered for existing and new risks,” Mathieson says.

While they may not result in actual property damage, cyber events can be every bit as disruptive and expensive as natural disasters.

The average cost of a small business cyber-crime incident is now $49,600, according to the Australian Signals Directorate’s Annual Cyber Threat Report 2023-2024. And the risk of falling victim has never been higher.

Business owners have become alive to the threat and are increasingly willing to mitigate it with cyber insurance cover.

“Traditionally this cohort would be more concerned about the threat of a fire insurance claim to their property, but they now perceive cyber-crime as a far more likely occurrence,” Mathieson says.

Climate change is making it harder for small businesses situated in high-risk areas to gain access to cost effective cover, with those in parts of northern Australia particularly hard hit.

Banding together to seek better prices and conditions can help them gain access to the protection they require.

“Expect to see more businesses looking for alternative ways to manage this risk,” Mathieson predicts.

No two small businesses are the same and nor are their respective risk profiles. An experienced insurance broker can help you identify the vulnerabilities and emerging risks yours faces.

“It’s crucial to stay informed and to work with a professional to develop tailored risk management solutions beyond just insurance,” Mathieson says.

Drawing on the expertise of a broker who is familiar with your industry can help you get a handle on your evolving risk profile, and a growing number of Australian SMEs are seeking out this specialist assistance.

“Find someone who specialises in your industry or occupation and who can understand what you’re up to from day to day in your business,” Mathieson advises.

The right insurance cover can help to protect your small business from a range of adverse incidents and events. A broker can help you determine what type and level of cover will best meet your needs. If you’d like to review your current policies or chat about your requirements, contact your AIB broker today.

Important notice

This article is of a general nature only and does not take into account your specific objectives, financial situation or needs. It is also not financial advice, nor complete, so please discuss the full details with your Steadfast insurance broker as to whether these types of insurance are appropriate for you. Deductibles, exclusions and limits apply. You should consider any relevant Target Market Determination and Product Disclosure Statement in deciding whether to buy or renew these types of insurance. Various insurers issue these types of insurance and cover can differ between insurers.

Steadfast Group Ltd ACN 073 659 677

Important notice – Steadfast Group Limited ABN 98 073 659 677

This article provides information rather than financial product or other advice. The content of this article, including any information contained in it, has been prepared without taking into account your objectives, financial situation or needs. You should consider the appropriateness of the information, taking these matters into account, before you act on any information. In particular, you should review the product disclosure statement for any product that the information relates to it before acquiring the product.

Information is current as at the date the article is written as specified within it but is subject to change. Steadfast Group Ltd and Steadfast Network Brokers make no representation as to the accuracy or completeness of the information. Various third parties have contributed to the production of this content. All information is subject to copyright and may not be reproduced without the prior written consent of Steadfast Group Limited.

Bushfires are becoming a perpetual risk, regardless of the time of year in Australia. A wetter than average summer can lead to a higher risk of bushfires in the drier period due to the increased vegetation growth. In our recent blog, Disaster Preparedness For Businesses, we highlighted the measures you can take to prepare and deal with a natural disaster. But there are steps you can take now to ensure peace of mind that your business is well insured when the fire risk is high.

While the dry season, which is usually Winter and Spring, is generally peak bushfire season in the Northern half of the country, in the Southern states, Summer and Autumn can pose the biggest threat. Australia’s hot, dry climate makes it one of the most bushfire-prone regions in the world. For businesses, this natural hazard poses significant risks, from property damage to prolonged operational disruptions. Taking out adequate insurance is not just a precaution; it’s a crucial investment in the resilience of your business.

Research shows that bushfire risks are rising across Australia, especially in coastal WA, central Queensland and in large parts of NSW, Victoria and the ACT. Bushfires can spread with little warning and can be unpredictable, with the potential to cause damage due to smoke or water as well as the fire itself. Even businesses outside of the fire zones can feel the impact of bushfires, with supply chain disruption affecting their ability to access goods and demand surge increasing the difficulty of accessing some services.

Bushfires can devastate businesses by causing:

With bushfires becoming more frequent and severe, ensuring your business is prepared is vital.

While you can’t control the weather, insurance can help to protect small businesses across Australia from the risks bushfires pose to both their premises and trading. Contrary to popular belief, bushfires are not just a threat facing rural businesses. Thanks to the urban sprawl of our cities, outer metropolitan suburbs are meeting the bush and increasing the risk to more businesses Australia-wide.

While all businesses should evaluate their risk exposure, bushfire insurance is particularly important for:

Having adequate business insurance can give you peace of mind that if a natural disaster, such as a bushfire, impacts your business, you are well positioned to recover more quickly.

The types of business insurance you should consider include:

Property insurance covers damage to your business premises, equipment, and stock caused by fire.

Business Interruption Insurance protects against income loss during and after a bushfire.

Ensures your business’s furniture, equipment, and other contents are covered.

If your business relies on vehicles, commercial motor insurance is essential.

Liability insurance protects against claims if a bushfire originating on your property causes damage to neighbouring properties or injuries.

When evaluating your options, consider the following steps:

Business Pack Insurance can cover a number of these areas in one easy-to-manage policy.

Don’t wait until the threat of bushfires is higher, contact an AIB broker today for a review of your current policies. Contact us today for expert advice and tailored policies to protect your business against bushfires, motor vehicle damage and other natural hazards.

Important notice

This article is of a general nature only and does not take into account your specific objectives, financial situation or needs. It is also not financial advice, nor complete, so please discuss the full details with your Steadfast insurance broker as to whether these types of insurance are appropriate for you. Deductibles, exclusions and limits apply. You should consider any relevant Target Market Determination and Product Disclosure Statement in deciding whether to buy or renew these types of insurance. Various insurers issue these types of insurance and cover can differ between insurers.

Steadfast Group Ltd ACN 073 659 677

Important notice – Steadfast Group Limited ABN 98 073 659 677

This article provides information rather than financial product or other advice. The content of this article, including any information contained in it, has been prepared without taking into account your objectives, financial situation or needs. You should consider the appropriateness of the information, taking these matters into account, before you act on any information. In particular, you should review the product disclosure statement for any product that the information relates to it before acquiring the product.

Information is current as at the date the article is written as specified within it but is subject to change. Steadfast Group Ltd and Steadfast Network Brokers make no representation as to the accuracy or completeness of the information. Various third parties have contributed to the production of this content. All information is subject to copyright and may not be reproduced without the prior written consent of Steadfast Group Limited.